A great resource for Connecticut students and their families!

Welcome to CT Dollars & Sense

Connecticut’s one-stop shop for helping you plan, save and pay for college. We have the information that you need – whether you’re trying to save, looking for scholarships, considering a loan, or just want to figure out how to put it all together.

What’s New

Scholarships

Invest in your future by applying for these Connecticut scholarships

Money Tips

New resources and articles added to managing money!

Career & Job Search

New resources and articles added to finding a career!

Refinancing

Unlock financial freedom through student loan refinancing

Saving for College

529 Plan: Frequently Asked Questions

Saving for college can be challenging, but with a clear plan, it doesn’t have to be overwhelming. By setting achievable goals and exploring various financial aid options, you can make the process manageable and secure a brighter future. Here’s a few resources to help get you started.

Check CHET Out!

Start saving for college with only $25 and only 15 minutes. CHET is designed to help families save for future college costs.

A College Account for Babies in CT!

Did you know the state will provide up to $250 to start a college account for babies in CT? Get your Baby Scholars bonus today!

How much do I need to save for college?

Not many people can save 100% of college costs. But every dollar saved is one dollar less than you might need to borrow or pay in the future.

Paying for College Facts & Tips

Start early and explore all available financial aid options, including scholarships, grants, and work-study programs, to minimize student loan debt.

2026-2027 FAFSA Checklist

This FAFSA checklist will preapare and help you determine which documents you’ll need to complete the 2026-2027 form.

College Score Card

Find the right fit! Search and compare colleges; their fields of study, costs, admissions, results, and more.

Introducing the financial aid award letter

Shortly after being accepted by a college, you’ll receive a financial aid award letter spelling out all the details of your financial aid package. In this video, we’ll detail what you can expect to see.

A student's guide to working with a financial aid office

Entering the world of higher education is an exciting journey. But for many students, the financial aspect can be daunting. That’s where your school’s financial office comes into play. This vital resource is there to help you understand and manage the financial side of your educational journey.

How will the number credits I take impact my financial aid?

You don’t have to be enrolled full-time to receive most types of financial aid, but it does get tricky, In most cases, the amount of aid you receive will be determined by the number of credits you are currently taking.

Financial aid resources for DACA Students

Only about 15% of DACA students who graduate high school will go on to college. Though these students aren’t eligible for federal financial aid, there are other programs and resources available that can help them achieve their collegiate dreams.

Paying for College When You Have a Green Card

For many green card holders in the United States, financing college expenses can feel overwhelming. However, finding solutions to the college financing puzzle can be less daunting with the right guidance and knowledge.

Can I Receive Financial Aid if I Have Bad Credit?

You can still receive financial aid with bad credit. Learn how in this quick video tutorial.

Paying for College Facts & Tips

Start early and explore all available financial aid options, including scholarships, grants, and work-study programs, to minimize student loan debt.

How will the number credits I take impact my financial aid?

You don’t have to be enrolled full-time to receive most types of financial aid, but it does get tricky, In most cases, the amount of aid you receive will be determined by the number of credits you are currently taking.

Financial aid resources for DACA Students:

Only about 15% of DACA students who graduate high school will go on to college. Though these students aren’t eligible for federal financial aid, there are other programs and resources available that can help them achieve their collegiate dreams.

Introducing the financial aid award letter

Shortly after being accepted by a college, you’ll receive a financial aid award letter spelling out all the details of your financial aid package. In this video, we’ll detail what you can expect to see.

A student's guide to working with a financial aid office

Entering the world of higher education is an exciting journey. But for many students, the financial aspect can be daunting. That’s where your school’s financial office comes into play. This vital resource is there to help you understand and manage the financial side of your educational journey.

College Score Card

Find the right fit! Search and compare colleges; their fields of study, costs, admissions, results, and more.

FAFSA Completion Resources

Scholarship Information

Navigate your path to educational excellence with our comprehensive scholarship information.

CHESLA Need-Based Scholarship

CHESLA is excited to continue to award scholarships to eligible students in pursuit of higher education in the State of Connecticut.

Scholarship Center

Our Scholarship Center provides a curated selection of hand-picked scholarships, tailored to match your unique qualifications and needs. Discover and apply for funding opportunities with ease, ensuring you get the financial support necessary to achieve your educational goals.

Higher Heights Scholarship Directory

The Higher Heights Scholarship Directory offers a monthly-updated list of scholarships for Connecticut students at all education levels—high school, undergraduate, and graduate.

Hartford Promise Scholarship

A large-scale college scholarship is available for Hartford public school students to help fill the gap, which can be applied toward both 4-year bachelor’s degree and 2-year associate’s degree programs.

American Savings Foundation Scholarship Program

The American Savings Foundation Scholarship is the largest independent college scholarship program from a single source of funds in Connecticut. Each year nearly 400 ASF Scholars attend community colleges, 4-year institutions, and technical or vocational programs in Connecticut and beyond.

Hartford Foundation of Public Giving Scholarship Portal

This portal includes over 100 scholarship opportunities for Greater Hartford students!

Ultimate Guide to Earning a Scholarship

Scholarships are a great way to reduce your out-of-pocket cost of education. Read the guide to learn how to maximize your awards, identify the best scholarships for you, and craft winning applications that stand out to selection committees. With the right strategies and resources, you can significantly lower your education expenses and focus on your academic success.

What Is the Difference Between a Scholarship and a Grant?

Scholarships and grants share a key similarity: both typically do not need to be repaid. However, they differ in how they’re awarded and their specific eligibility requirements.

Common Mistakes to Avoid When Applying for Scholarships

Seeking scholarships can be a great way to secure financial support for your education, but pitfalls and challenges can affect your progress. From deadline mishaps to essay blunders, we’ll explore common scholarship application mistakes and how to avoid them.

Crafting a Winning Scholarship Essay

Writing a compelling essay can be a crucial part of applying for scholarships. While other portions of the application are plain facts, the essay is your opportunity to express your aspirations, experiences, and unique perspective.

Scholarship Application Tips

When applying for scholarships, it’s important to equip yourself with the right tools and strategies, so you can navigate the process with ease. To help, we’ll look at some key elements that can elevate your scholarship application game.

Student Loans

Student loans can open the door to higher education, making it possible to achieve your academic and career goals. By carefully selecting loan options and understanding the repayment process, you can manage your finances responsibly and invest in a brighter future with confidence.

CHESLA

CHESLA is committed to helping students and families finance the cost of education. With fixed annual rates and all the information you need to get started.

Student Loan Affordability Calculator

Will you be able to afford your future student loan payments? Quickly calculate if your student loans may be affordable for you based on your anticipated career and salary.

Loan Payment Calculator

When you decide to take out a loan, or borrow money of any kind, you need to understand the terms of the loan and your financial obligations in their entirety. The best way to stay organized and manage your borrowed money is by creating a repayment plan.

Determining How Much to Borrow

Whether this is the first year, you’re considering borrowing student loans or you’ve been borrowing them for several years, there are several questions you’ll need to ask yourselves.

Smart Student Loan Borrowing

Taking the time to select the right loan and borrowing less in the first place can save you a lot of time, money and stress in the future. In this video, we’ll discuss some smart borrowing strategies.

Check out Refi CT

CHESLA’s student loan refinancing program is dedicated to helping CT residents manage their student loans!

Life is about dreams. Achieve yours.

The money management tool students love and schools trust.

Create Your iGrad Account Today CHESLA and CT Dollars & Sense have partnered with iGrad to provide Connecticut students and their families access to iGrad’s award-winning financial literacy platform. While we highlight certain iGrad information on CT Dollars & Sense, creating an account provides a more personalized and in-depth financial literacy experience.

Once you create your account, you can complete a short assessment and iGrad will then design a customized dashboard for you. From there, you can access tools, calculators, articles, videos, interactive games and explore courses on various financial topics. To get started today, click below to create your account.

Office of Higher Education

State Financial Aid Programs

Access state financial aid programs for college funding.

Programs & Initiatives

Explore programs and initiatives for educational funding opportunities.

Searchable Databases

Connecticut’s colleges and universities, programs and fields of study, collegiate enrollment data, and more!

Connecticut Department of Consumer Protection & Connecticut Department of Banking

Connecticut Department of Consumer Protection

Works with non-profits, businesses and educators to expend access to financial literacy for students across the state

Connecticut Department of Banking

The DOB regulates the financial services industry in Connecticut, and advocates for consumers and investors. We are the primary state regulator for securities, consumer credit and state-chartered banks and credit unions.

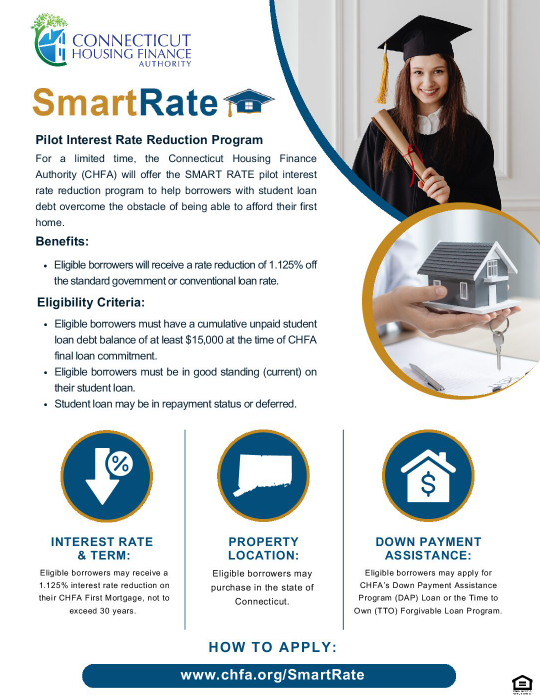

Connecticut Housing Finance Authority

Now offering the SMART RATE pilot interest rate reduction program to help borrowers with student loan debt overcome the obstacle of being able to afford their first home.